May 12, 2022 Update

The bursting stock market bubble is rapidly deflating now. Incredibly, only 9.89% of Nasdaq stocks are above their 200-day moving averages now! This is a historic decline! Most leaders - now former leaders - are down 50% to 90% from their highs.

This article was originally published on February 16, 2021, and last updated May 12th, 2022

The FANG stocks - once market darlings considered immune to widespread selling - are all in bear markets now. The Nasdaq is down 30% and the S&P hit bear market territory today.

Economic risks continue to dampen enthusiasm for stocks as more and more companies are reporting lackluster earnings or are warning about business going forward. The ongoing downward repricing in growth stocks reflects previously unrealistic investor expectations going forward, especially in a rapidly rising interest rate environment.

Given the massive carnage in the market, the best precedent unfortunately is the 2000-2002 market top. This much wealth destruction in a short amount of time does not heal in just a few months.

In past panics and declines, the Fed always came to the market's rescue in the form of interest rate cuts and massive fiscal intervention.

The problem now for the stock market is that the Fed is powerless to do anything to stop the decline - it's being forced to raise interest rates aggressively to combat 40-year high inflation that they are in large part responsible for.

It's highly likely the decline will continue through 2022 and possible beyond, interspersed with some powerful and very convincing bear market rallies

January 22, 2022 Update

The bubble has finally burst! Extremely high valuations on a historical basis and rising interest rates are a recipe for declining stock prices, and we're now seeing a rapid decline in the market. There's a strong chance that the market has put in a long-term top now, and it's looking more and more like a bear market may be in the near future.

Actually, the Nasdaq has been in a stealth bear market since November, with many (now former) leaders down 50% to 80%.

The market has been putting out warning signs for months now, with poor stock participation and decreasing breadth, and breakouts that have on balance failed.

The technical picture for the market is very poor now. The percentage of stocks above their 200-day moving averages is now at 31.27%, the lowest percentage since June 2020. It's even worse on the Nasdaq - its percentage of stocks above their 200-day moving average is now down to 16.84%!

The Russell 2000 has collapsed below support levels that held throughout 2021 and is now at 1-year lows. Its 50-day has now crossed below its 200-day, creating the “death cross”.

Cathie Wood’s ARKK fund is now down 24.39% this month alone, and down 55.2% from all-time highs in February 2021. It’s a sobering lesson in bottom-fishing growth stocks in a major correction – it's a recipe for disaster!

November 11th, 2021 Update

We continue to see all the signs of a major market top forming.

But as of now, the market continues to plow ahead with repeated new all-time highs. So, the trend is still strongly up.

Updated Monthly Charts

I have updated the long-term monthly charts for the Nasdaq and S&P below.

Stock Market Monthly Charts - Breaks Above Upper Trendlines

The following charts show the Nasdaq and S&P breaking above their long-term trendlines going back to 2009. This is a major warning sign that the rally has become overheated.

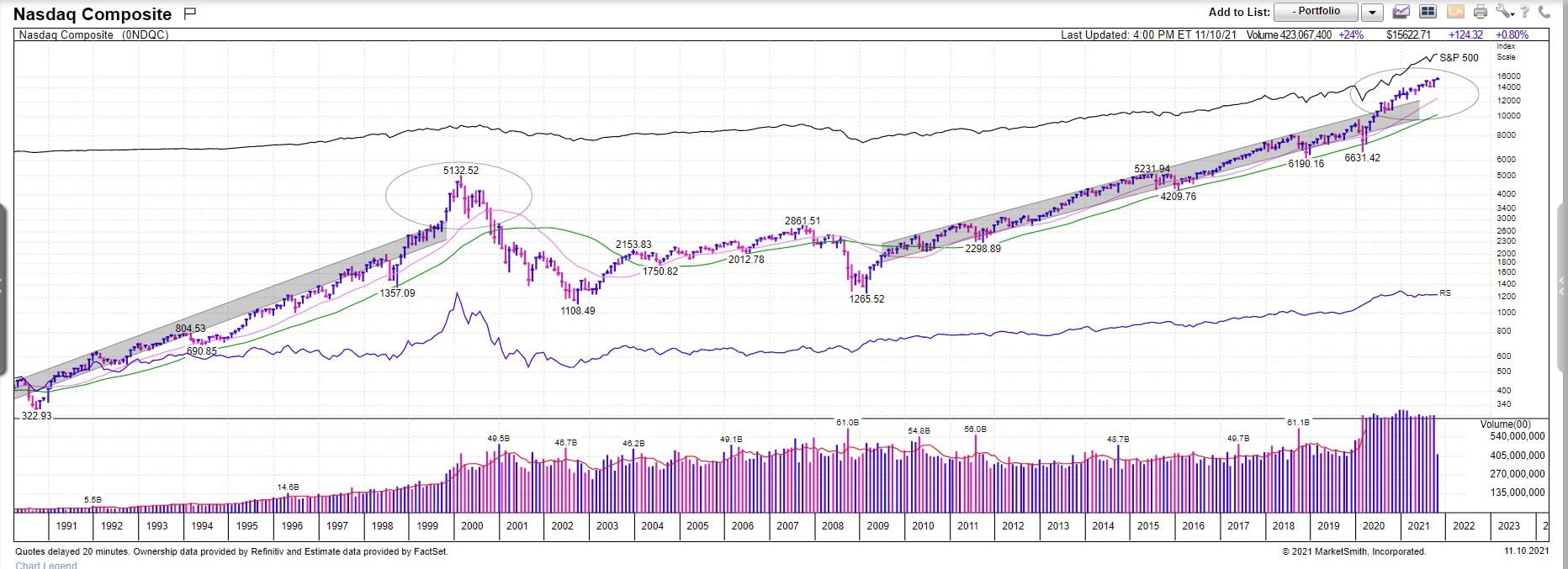

Nasdaq: 1991 - 2021

In the following chart, you can see how the Nasdaq exploded above its upper trendline in 1999 to its peak in March 2000 (the circled area). The rate of ascent of the move also accelerated in a climax run.

Today, we are seeing the same type of movement over the last 12 months as the index broke above its upper trendline in September 2020.

The Nasdaq is now also 54% above its 40-month moving average (the green line). The last time it went this high was January 1999. It could go much higher, as at the March 2000 peak when the Nasdaq went vertical for 6 months, it topped out 123% above the 40-month MA.

Nasdaq Chart: 1991 Through November 2021:

(Click to enlarge)

S&P 500: 1991 - 2021

The following chart shows the S&P breaking above its upper trendline 8 months ago.

The S&P has not been this far above its 40-month moving average (the green line) since June 1999.

S&P Chart: 1991 Through November 2021:

(Click to enlarge)

Updated IPO Stats:

Just as in 1999 when a flood of companies came to market with extravagant valuations, in 2021 more than 1,000 IPOs are expected to come to market by the end of 2021, for a total of $266 billion. This compares to 132 IPOs, including 50 blank checks, totaling nearly $59 billion for the same time in 2020.

A frenzy of IPOs is usually a sign of a peak in speculation that has corresponded to market tops in the past.

Shiller P/E Ratio

The following chart shows the Shiller P/E ratio going back to the late 1800s. At 41.9, it is far above the historical average of 17.2. And this level has only been surpassed once, at the peak of the 1996-2000 Internet bubble

(Click to enlarge)

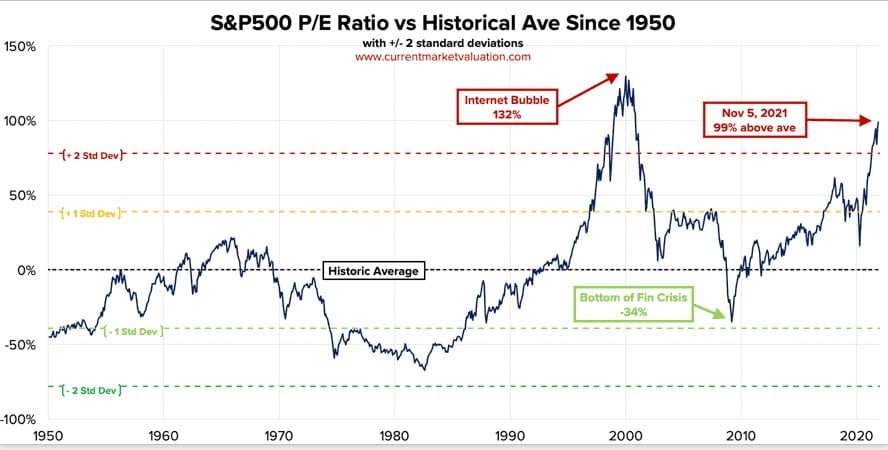

S&P 500 P/E Ratio vs Historical Average

The following chart shows S&P's P/E ratio vs. the historical average since 1950. It is currently at 99% above the historical average, a level only surpassed at the peak of the Internet bubble in 2000 where it hit 132%.

(Click to enlarge)

Total Market Cap to Total Profits

The following chart shows the ratio of total market cap to gross value-added or total profits. Huffman Advisors says this indicator of valuation is "more strongly correlated with actual subsequent market returns than any other measure we've tested or introduced." It is far above its highest level ever in the past 70 years.

Chart courtesy of Huffman Strategic Advisors.

(Click to enlarge)

4 Combined Valuation Indicators

The following chart shows an average of four valuation indicators.

Chart courtesy of Advisor Perspectives.

(Click to enlarge)

CAPE Ratio

The CAPE Ratio is one of the best yardsticks for measuring how overpriced or underpriced the S&P relative to its historical prices.

It measures cyclically-adjusted P/E ratios using a 10-year average of earnings per share, adjusted for inflation.

In November, 2021, the CAPE ratio hit 38.39, more than double its long-term average, and is at levels have only been reached once before in the last 150 years, in 2000. The reading just prior to the stock market crash of 1929 was 32.56.

Another way to look at this is that large-cap stocks have only been this expensive 4% of the time in the recorded history of stock markets.

The ratio is also above the +2 standard deviation level on a chart. Prices that get extended above the historical average always not only return to the historical average, but overshoot beneath it.

At today’s elevated level, the CAPE ratio points to poor results for the next five to ten years.

CAPE Ratio Chart

(Click to enlarge)

Buffett Indicator

The Buffett Indicator, Warren Buffett’s favorite market valuation indicator, is currently at 215%, signaling stocks are extremely overvalued. . It has moderated, however, a little since June 2021 when it hit 236%. Nonetheless, it is 72% above the historical average.

It is calculated by taking the total market cap of all publicly traded stocks and dividing it by the most recent figure of GDP. The Wilshire 5000 Total Market Index hit $44.3 trillion on Tuesday, while GDP is estimated at $22.1 trillion.

Buffett had this to say, "If the ratio approaches 200%—as it did in 1999 and a part of 2000—you are playing with fire."

Overvaluation is not just limited to U.S. stocks. The global stock version just hit 133%, well above its peak reading during the dot-com boom.

For reference, the Buffett Indicator hit 167% during the Internet bubble that peaked in March 2000.

Buffett Indicator Chart

(chart courtesy of www.currentmarketvaluation.com)

(Click to enlarge)

Bank of America Sell-Side Indicator (SSI)

The Bank of America Sell-Side Indicator notes sell-side strategist's equity allocations. It is currently at its highest point since May 2007. At 59.4%, it is very near the 60% threshold that triggers a contrarian sell signal.

BofA SSI Chart

(chart courtesy of BofA Equity & Quant Strategy Note)

(Click to enlarge)

S&P 500 Price to Revenue

Let's looks at the valuation of the S&P 500 another way. The following chart shows that the valuations in each decile of the S&P 500 by price to sales. The valuations are now at their highest in history.

S&P 500 Price to Revenue Chart

(chart courtesy of Business Insider/ Hussman Strategic Advisors)

(Click to enlarge)

Margin Debt

Margin debt has exploded to nearly $1 trillion, a warning sign of excessive speculation and optimism. A Ned Davis Research analysis found the market is at risk of a major decline when margin debt starts descending from major peaks. The S&P 500 followed those periods with losses three to 18 months later.

Excessive margin debt has marked three market tops since the 1970s. This contrarian sentiment indicator exceeds 55% during times of extreme optimism on Wall Street, when investors are heavily borrowing money during the late stages of a bull market.

Margin debt recently has been cooling. We are currently at the 8th month of descent from a major peak in March 2021, when it hit 71.62%. May 2021's total was 55.94%. June came in at 50.87%, while September's total was 38.0%

Margin debt is likely much higher than these numbers suggest, as widespread use of leveraged ETFs is not included in these numbers.

Margin Debt Chart

(Click to enlarge)

Bubble Prices in Real Estate and Cryptocurrencies

Bubble pricing in other assets than equities supports the fact that emotions, rather than facts, lead to extreme optimism and speculation in the markets.

Real Estate Prices

Adjusted for inflation, the Case-Shiller Home price index is currently higher than in 2006, the peak of the last housing bubble.

Case-Shiller Home Price Index Chart

(Click to enlarge)

Bitcoin

Bitcoin's trading over the last 12 months has been far removed from anything rational, a hallmark of a bubble. Its biggest moves this year have come in reactions to tweets from Elon Musk.

Bitcoin has been very volatile, declining 50% from highs hit in April 2021, but then running up into new highs in November 2021.

Bitcoin Chart

(Click to enlarge)

Stock Market Overvaluation

The following chart was put together by Stefan Hofrichter, head of global economics and strategy at German fund management giant Allianz Global Investors.

He says, “Monetary policy over the decades has lifted investors’ risk appetite to extremes, powering the run-up in equities.”

“History has shown that bubbles only burst once central banks start to hike rates or take other steps to rein in their ‘easy money’ policies.” Until the Fed starts tapering its bond purchases, “we think there is a reasonable chance that U.S. equities will continue bubbling up further."

Stock Market Bubble Check List

As of November 17th, 2021, most of the elements on this bubble checklist (first created on Feb 16, 2021) are all still in play. A few elements have moderated a bit.

April 19, 2021 update

The Nasdaq, S&P and Dow have now broken above their upper monthly trendlines going back to 2009. This type of action has historically led to bull market tops.

Margin debt numbers for March 2021 were released today. Margin debt (year-over-year) rose to a shockingly high 71.62%, way past the 55% that has flagged other major market tops in the past.

It is currently much higher than any peak since 1995, and, while I can’t find a chart going back farther, it’s likely well past other peaks in the last 50 years.

This level of debt is typically seen during the late stages of a bull market.

Please see the whole Bubble checklist below!

April 1, 2021 update

I've just updated the data on the high number of IPOs that are coming out that's drawing comparison to 1999. There were 100 IPOs in the first quarter of 2021. That's the most since the 133 IPOs in the third quarter of 2000. Add in SPACS, and the total number rockets to 398. On average, the amount of IPOs in a typical year is about 200.

March 29, 2021 update

The stock market has turned into a split bifurcated market. The Nasdaq, with its preponderance of growth and tech stocks, is acting poorly. Many leading stocks from 2020 are now showing signs of long-term tops.

Given the weakness in the Nasdaq, it doesn't look like it will go on a final blow-off top at this point, though anything is possible. More likely the whole market is going through a drawn out topping pattern.

March 11, 2021 update

The stock market bubble, incredibly, is reinflating! Fed Chairman Powell has led investors to throw caution to the wind as there is no perceived downside now to the stock market. Powell has everyone’s back and will lead us all the unprecedented wealth. All he has to do is turn his magic levers – pump more money in or manipulate interest rates - and voila, everything is good.

In fact, he doesn’t even have to actually do anything, he just needs to say he could turn the levers, because the Fed is perceived as having unlimited powers.

This is dangerous thinking as it’s not true. And there are always unforeseen results based on actions made politically or in the interests of certain powerful parties.

In normal markets, once a bubble pops, it plays out to its logical end, which is an elimination of all the off-the-charts bullishness, speculation, leverage, and other excesses. In fact, just as all bubbles overshoot to the upside as greed takes over, when they burst they overshoot to the downside as fear becomes rampant.

But today the markets are not being driven by rational thought and analysis, but by greed driven by the ramifications of with almost $4 trillion dollars being pumped into the economy and the financial system, without thought to how it will all turn out.

It’s an unprecedented experiment with the U.S. economy, which will create lasting damage the more the excesses are allowed to build.

Bubble Check List

As of today, ALL of the elements on the bubble checklist (first created on Feb 16, 2021) are all still in play. Incredibly, many are showing even greater signs of excess that before. For example, investors are piling right back to stocks like Gamestop, Koss, and others that exhibited classic blow-off tops. And tech growth stocks are seeing “buy the dip” on just about every correction down even of a few percent.

Here is the list (copied from our February 16th section below):

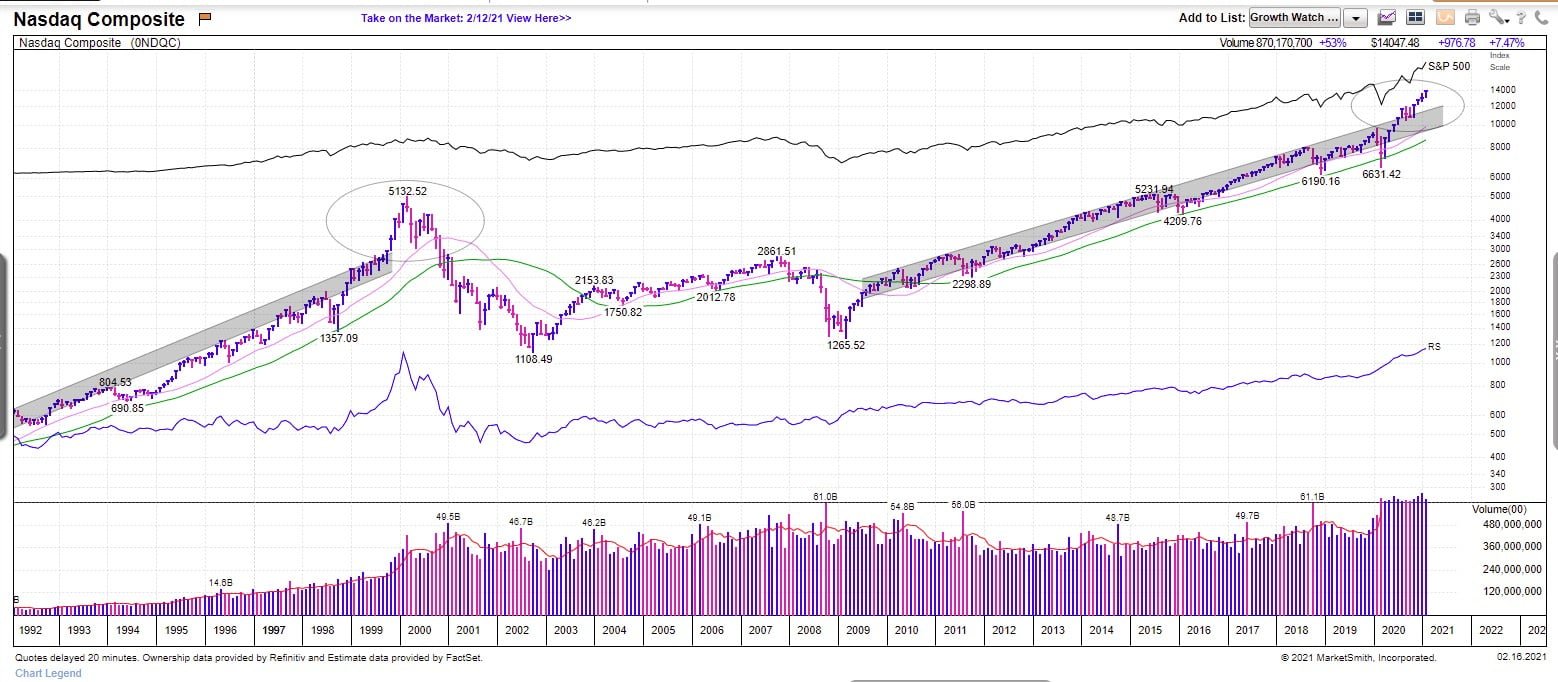

Here’s an updated chart of the Nasdaq:

(Click to enlarge):

Based on current action, it looks we may have a final blowoff top that takes the Nasdaq up to around 15,000 to 15,500.

Timeframe? Another 6 months to a year of market bubble action would fall historically in the overall 2-3 years that most bubbles play out.

Of course, anything can happen, but as of today, the bubble has not burst and is back inflating again.

February 27, 2021 Update

Last week saw some leaks appearing in the stock market bubble.

The Nasdaq broke below its 50-day moving average. As of Friday, February 26, the Nasdaq is right below that key moving average. Let’s take a look at the chart:

(Click to enlarge):

The red line is the 50-day. We're starting to see more institutional selling (higher volume on down days). However, we’re only 8 days from the all-time high so there's nothing conclusive here yet.

Let’s take a look at the standard deviation chart for the Nasdaq:

(Click to enlarge):

The index is getting support at the -0.5 standard deviation (that’s the red dotted line). Twice in recent months the Nasdaq found support at that line after spending a few days below it.

Bullishness Still Reigns

Trader psychology is still very bullish and there is still no sign of fear.

Despite some powerful down days, there are still many large speculative moves going on in stocks each day:

(Click to enlarge):

Margin Debt

I want to add a new chart of margin debt vs. the S&P 500. We have far surpassed the peaks in 2000 and 2007. Margin debt reached a record high at the end of January. If the market starts to decline significantly, this will trigger margin call selling which will exacerbate the move to the downside This was a major factor in the 20% stock market decline in the first quarter in 2020.

(Click to enlarge):

Upcoming Jobs Report on Friday

Continued strength in the economy is starting to create a downdraft for the market. Long-term interest rates are starting to rapidly move up, lessening demand for stocks. And continued strong job growth may point to less need for fiscal stimulus from the Fed which the market is counting on to propel it higher.

Revisiting the Internet Bubble 1996-2000

The following is taken from an article I published some years ago. Doesn’t this all sound familiar today?

Let’s take a moment here to talk about the Internet stock bubble of 1996-2000. This one was a doozy – probably the likes of which will never be repeated. The promise of the Internet, and what it meant to business, productivity, communications, investments, and jobs – life in general – was and still is monumental. But investors got caught up in the great promise of riches to be found, and the market-changing stories companies told, and prices went crazy.

Companies with no earnings, with nothing but a great story, were given tens of millions of dollars to build their businesses. Many of them never even came out with a product before burning through all of the cash given them.

I lived through this one personally, witnessing the action firsthand as a daytrader. I was part of a group with two other traders that formed to daytrade stocks.

The whole bubble was so crazy that all people cared about was that a stock was linked to the Internet, China (because of a new trade pact), fiber optics, data storage, or computer chips. That was all that was needed to send a stock up 200 %, 300%, or more, sometimes in a few days! It was a crazy time, to say the least!

My daytrading group and I would check the newsfeeds throughout the day for any news reports on companies that had to do with Internet, China, patents, or other keywords. Penny stocks would routinely go from $0.50 to $3.00/share within 20 minutes. Our plan was to buy the stock within seconds of the news being announced, before the crowd reacted, and then sell out to the suckers, er… investors who came in later (later sometimes being 30-60 seconds later). Most of the time, the stock would go right back down below $1.00, so you had to be quick!

One “winner” was China Prosperity International Holdings Ltd. In 1999, the name alone was enough to send stock traders into a frenzy! I think the irrational rationale was that a stock with China in the name would benefit from the growing economic partnership between China and the U.S. at the time.

The stock went from around $1.00 to $80.00 in one day, on some positive U.S.-China news! For most of the next 6 months it floated around $10/share, until the bubble burst and it went to zero……

The interesting thing was this: no one bothered to read anything or know anything about any of the stocks they bought; all people cared about was that the stock was going up. It was all about momentum trading.

I remember one stock called NetJ, which had risen up to $7.00/ share from around $0.50/ share less than a year earlier. At one point the company had a valuation of $47.5 million. I took the time to read the SEC 10-SB form that all public companies are required to file.

Their statement clearly said the company had no clients, no customers, and no day-to-day operations! It was a corporation that really just existed in a filing cabinet somewhere. NetJ had the word Net in it, as in Internet. That was good enough, I guess, for the stock to shoot up 1,400%.

I bought and sold dozens of stocks that I never knew anything about what they did, or even if they had a business plan. One stock used to sell fish fertilizer; then one day they changed their name to something like Internet China Products, and gained like 1000% in the next few weeks.

Companies would announce stock splits, and quickly zoom up. I remember Qualcomm, a company that makes and licenses mobile computing products and services, announcing a 4:1 stock split, when the stock was around $200/share. I remember buying a few shares here and there as it quickly rose to $800/share, I think in just over a week or so.

I remember thinking, “What am I doing? I just bought shares at $425/share today, when yesterday I bought it at $275. The morning it split at $800/ share, my shares had quadrupled in number, and I sold out with a nice profit.

Once the bubble burst in early 2000, all of these stocks quickly came back to earth. Many flamed out in a few weeks, and went to zero. Pets.com, Books-A-Million, Be Free, Webvan, and many others ended up in bankruptcy with complete losses for their investors. Many others were forced to regroup, and some moved on to become large, established companies today like Amazon and eBay.

This crazy bubble will not be the last stock market bubble. History tends to repeat itself. As long as people are motivated by fear and greed, there will always be stocks that shoot up way too high, and others that fall way too low.

Before I end this section, I want to mention another stock that was notable. The company went public on July 4th at $25 per share. On its first day of trading, it jumped to $40, then $50.

A month later, on August 10th, it was trading at $280 and on August 11th, it peaked at $310. The next day it fell to $212 and by the 15th it was down to $172, ending the year at $150.

What was the name of this stock? Another of the highflier stocks of the dot-com boom?

No, this stock was the Bank of the United States and started trading in 1791. In 1790 Alexander Hamilton set it up to help restructure the new government’s $80 million of debt from the Revolutionary War.

Somehow shares of this hot IPO ended up in the hands of members of Congress, the Secretary of War, and other influential citizens. Hmmm, somehow that is not surprising………

Investing In A Bubble Guidelines

My experience gained over 20 years in the markets has taught me the following:

1) When prices go into bubble territory, the craziness will last much longer than you think. Once you think it is really nuts, it will likely go on another 12 to 18 months. If you can hang on 12-18 months once the craziness begins, you will catch a big part of the final upward move in prices.

2) Use indicators like news headlines, charts, and daily anecdotes. I remember having lunch one day in 2006, and overhearing a kid who was about 15 years old teaching three adults how he was buying and flipping houses. At that point the real estate mania was in full swing, but when you start to hear things like this, you know the party will end sooner than later. But it may be up to a year later than you think!

3) A good rule of thumb with stock investing is that when prices start going crazy and have three to four crazy huge upmoves in a row, it is probably time to start selling and locking in profits. Don’t sell your whole position, as the craziness will probably not be done yet.

Bubble Top Targets

Right now, we’re only 8 days from the all-time high. While we could have put in the top, I still think it's highly likely that the Nasdaq will continue up to around 14,700 to 14,800. This is based on the upper +1 regression channel on the chart above.

Bullishness is still extreme and "buy the dip" is still the overriding investing theme.

A brief move above 15,000 is also likely (the Nasdaq peaked in March 2000 just above 5,000). Markets always likes round numbers which act as a magnet.

There's still also the possibility of a final rapid meltup move up beyond 15,000, even above 16,000.

February 16, 2021

It’s been one hell of a party!

As of mid-February 2021, the Nasdaq (plus the Russell 2000, and to a lesser extent, the broader S&P 500) has entered what is in all likelihood the final inning of a spectacular stock market bubble that’s destined to be in the Top 5 of all time.

Since April 2020, after a brutal 5-week crash in the market due to COVID-19, the ensuing rally has been one of the most powerful moves in stock market history.

It’s been an unrelenting meltup/ lockout bull market move characterized by frequent panic buying and a disregard of any fundamentals.

Big Picture

What’s been driving this market rally?

The primary driver is that trillions of dollars pumped in at 0% interest rates by the Fed have fueled a speculative binge that, like all bubbles, starts rationally and eventually gets out of control.

The Stock Market Is A Discounting Mechanism

The stock market acts typically as a discounting mechanism, which means that it looks out 6 to 9 months. It is always looking forward and assigns prices today to what it sees happening in the future.

Incredibly, this market has been discounting ALL negative information since April 2020. It has truly climbed a wall of worry. But it has done this to such a degree that it became wholly disconnected from Main Street, with the moves driven not by data but by emotions, specifically greed.

This action is unprecedented, especially as there is still so much uncertainty with opening up the economy again. The stimulus money windfall triggered an avalanche of capital that poured into the stock market like gas poured on a fire.

In addition, the markets are drooling at the prospect of another $1.9 trillion in stimulus money being pumped into the economy within a few months. And a large percentage of those funds will likely find their way into the capital markets. That’s already being priced into the stock market.

Productivity Gains / Digital Business Transformation

Of course, one can argue that business is being forever changed by a rapid adoption/ upgrade to digital processes. Many business leaders have said that COVID-19 has accelerated their businesses’ digital transformation into one year, a process that would have normally taken 4 to 5 years.

Of course, this is a significant factor in many high-quality tech stocks' moves up, but it doesn’t account for the widespread manic speculative trading in stocks we only find in a market bubble.

Parallel Bubbles

As is the case in most other bubbles, other markets join into the frenzy. Bitcoin and residential real estate are also in extremely frothy territory.

Stock Market Bubble Laid Out

As I’ve been pointing out for some time now, we should be concerned that we now have ALL the elements in place that mark market bubble tops.

There are too many elements to ignore:

This Time It’s Different!

And finally, we are seeing market pundits, faced with all the signs of a bubble getting increasingly larger, smilingly tell us:

“This time is different.”

“The Fed won’t be raising interest rates until at least 2024.”

“The world is in a new technological paradigm shift that’s created a ‘permanently high plateau’.” (a nod to the noted economist Irving Fisher’s statement right before the crash in 1929.

“This time is different”… Never is!

Bubble Top Targets

Let’s take a look at where the Nasdaq currently stands. The charts will be updated as the rally continues to develop.

This first chart is a daily Nasdaq chart from April 2020. It shows +0.5/-0.5 and +1 / -1 standard deviations from a center line. The dotted lines are the -0.5/ +0.5 deviations and the solid lines are the +1 / -1 standard deviations.

You can see that the Nasdaq is currently hitting some resistance at the +0.5 line. Looking back to August, you can see that the Nasdaq hit the upper +1.0 line and sharply reversed. I expect the same to happen this time, or if there's a meltup, just blow past the upper line.

(Click to enlarge)

The next chart shows the Nasdaq from 1992 through today. You can see back the parabolic run from 1998 through 2000, and how it broke above the upper trendline (see the circled areas). The Nasdaq then crashed 82% over the next 2 ½ years.

Today, we have the same break above the upper trendline going back to 2009 and climbing at an accelerated rate. This type of move is not sustainable.

(Click to enlarge)

Bubble Top Targets

So far, we don’t have a price break or signs of institutional selling to confirm a top. It’s still up, up, and away!

And trying to pick a top is an impossible task, as emotions are driving the action.

However, we continue to have an initial target of 14,700 to 14,800 on the Nasdaq. This is based on the upper +1 regression channel on the chart above.

A brief move above 15,000 is also likely (the Nasdaq peaked in March 2000 just above 5,000).

Another possibility that’s becoming more likely is a final rapid meltup move up beyond 15,000, even above 16,000. This type of action will increase the likelihood that the bubble burst is imminent.

Bubble Aftermath

Once the bubble bursts, anything can happen. Remember, the Nasdaq fell 82% from March 2000 to October 2002.

It’s impossible to know if the coming correction will be short or long, shallow or deep. But with so many parallels to the dot-com rally and bust from 1998 to 2000, a deeper and longer correction may be in the cards.

More to come as events unfold!

Lou Lucarelli

Great article, as always. With such a bubble, once the market trend advisory goes from yellow to red, will it be too late to get out?

Michael

No. Interestingly, in studying market tops, especially the March 2000 top, they don’t go straight down. There is usually a test of the high which of course fails. The bigger plunge starts are the failed test of the high. Some stocks top out before the peak, but most will top out after the peak. The whole process can take a few weeks.

Steve

Thoroughly enjoyed reading your enlightened market assessment. Please continue.

Carlos

Really great info, thanks!!!!!