In October 2020, fund giant Invesco introduced two new Nasdaq-100 ETFs, the QQQJ and the QQQM. Both are following in the footsteps of the QQQ’s tremendous success over the last 21 years.

Let’s review the QQQ first and then see what each of these new ETFs offers.

The QQQ ETF is a large-cap ETF based on the Nasdaq-100 Index.

According to Invesco’s website, the fund invests in “100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund and the Index are rebalanced quarterly and reconstituted annually.”

The QQQ has been a mainstay for index investing for many years, with ample liquidity (an average daily volume of 34 million shares traded with the bid and ask usually a penny apart) and low fees (0.20% annually).

Below is a chart of its returns from its inception in March 1999 through September 2020. It outperformed the S&P 500 and Russell 2000 by a wide margin (click to enlarge):

The QQQ’s main drawback is its now high price (as of December 2020, more than $300/share). Smaller accounts either don’t have the funds to invest or can only invest in a handful of shares.

In October 2020, Invesco introduced the QQQJ ETF. It offers exposure to the Nasdaq Next Generation 100 index.

According to Invesco’s website, “The Fund will invest at least 90% of its total assets in the securities that comprise the Index by investing in the 101st to the 200th largest non-financial companies on the NASDAQ, that is, the largest 100 Nasdaq-listed companies outside of the NASDAQ-100 Index®. As a result, the portfolio may be concentrated in mid-capitalization stocks. They also have the potential to one day be added to the Nasdaq-100. The Fund and Index are rebalanced quarterly and reconstituted annually.”

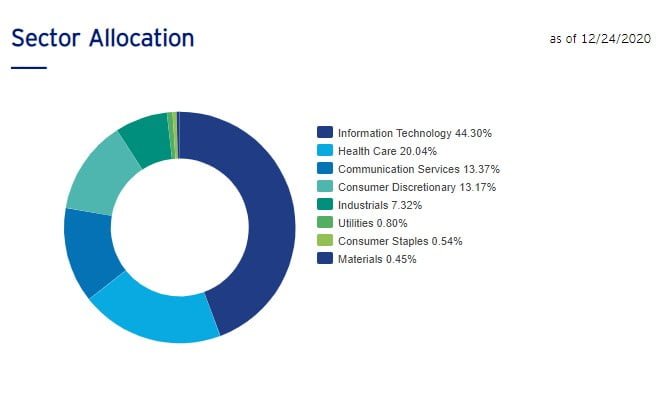

Its portfolio allocation mix (as of 12/24/2020) is the following (click to enlarge):

What I like is that its top holdings (as of 12/24/20) include many top growth names over the last few years:

Crowdstrike (CRWD)

Roku (ROKU)

The Trade Desk (TTD)

ZScaler (ZS)

Coupa Software (COUP)

Fortinet (FTNT)

Etsy (ETSY)

Liberty Broadband (LBRDK)

Take-Two Interactive (TTWO)

QQQJ has decent liquidity (average daily volume is 630,000 shares as of 12/28/20), and its expense ratio is a low 0.15%.

I like the idea of getting exposure to mid-caps in a lower-priced ETF. Its current price of around $30 is ideal for smaller accounts to get some leverage.

The QQQM, like the QQQ, tracks the Nasdaq-100 Index.

It’s essentially a cheaper version of QQQ but with a lower price (as of 12/28/20, $128/share vs. $309/share for the QQQ) and a lower fee (0.15% versus 0.20% for the QQQ).

Its main drawback is because it’s new, it trades less than 70,000 shares in average daily trading volume. It’s not currently usable for most accounts due to its low liquidity. But it will bear watching as it matures.

The following chart outlines the main differences between all three ETFs, plus a mutual fund version (IVNQX) (click to enlarge):

The QQQJ is an exciting development in ETF index investing. It offers a liquid way to get exposure to leading mid-caps stocks without single stock risk. Leading mid-cap growth stocks have outperformed large caps and small caps over the last decade.

I plan to use it with our Market Trend Advisory (MTA) Scenario 4 in a small account I’m setting up for a granddaughter. With the QQQJ’s lower price, I can effectively utilize its strategy of buying and adding shares based on the Market Trend Advisory’s Market Count, whereas, with the QQQ’s high price, there would not be enough funds to make the strategy work.

QQQM looks promising also but needs some time to mature and attract more trading volume.

Mitchell Farber

Can we please track both the QQQ and the QQQJ ?

Many of us already have existing positions in QQQ and value your guidance.

Thank you.

Michael

Hi Mitch,

Yes, I’ll be tracking the QQQJ once we start a new uptrend after a market correction.

Hedy Gelb

I had the QQQ and recently sold my shares. I would like to get back in, and am looking at QQQM and QQQJ. Do you have any recommendations. I am in ARKK, VO, VOO, VYM and XLF and XLE. I recently purchased XLV and XLI. I would like to sell XLV, any thoughts?

Michael

Sorry but I can’t give any individual investment advice.