Trading individual stocks using the Market Trend Advisory (MTA) system is a key part of generating outsized returns in your portfolio.

While many users get excellent returns using the system with index ETFs like QQQ or SPY, or using our investing strategies, you can vastly outperform the market indexes by using it with individual stocks.

Top growth stocks routinely return 100% to 200% more than the indexes. But by using the signals generated by the MTA, it’s possible to get even larger returns with much less risk and drawdown.

Let’s go over how you can use the Market Trend Advisory when buying and selling individual stocks.

1) Check The Individual Stock / Non-Index ETF Action Signals

Before buying individual stocks, you need to know how leading stocks are acting in general:

- Are there lots of stocks setting up in bases?

- Are there lots of breakouts?

- Are the breakouts working or failing?

Our Action Signals take into account a lot of technical action under the surface, including the following:

- How leading stocks are acting

- How breakouts are working

- The number of stock setups

- The number of recent breakouts that have not failed

- The number of stocks trending above their 200-day, 150-day, and 50-day moving averages

- Market internals and sentiment

- Market breadth

- Percentage of 52-week highs vs 52-week lows

This is important to know because individual stock performance can greatly diverge from the indexes at times. A great example is how stocks were acting throughout 2021 and especially from late 2021 through early 2022.

Throughout 2021, the indexes were strong and hit multiple new all-time highs as they were propped up by a handful of mega-cap stocks. But beneath the surface, most stocks were not acting well. In our Market Trend Advisory daily notes, we frequently talked about this major divergence – how there were increasing amounts of stocks on the Nasdaq that were in bear markets while the indexes were just off all-time highs. At one point in early 2022, over 80% of Nasdaq stocks were in downtrends under their 200-day moving averages, and many well-known names were down 50% to 80% or more. But the indexes were still near highs.

Action Signals: A Closer Look

Let’s take a closer look at how following our Action Signals kept investors out of the market or with very little exposure before the bear market that hit the Nasdaq from January through early March 2022.

Here are the Nasdaq-based signals from late November 2021 through mid-January 2022:

The signals showed little to no exposure to the market BEFORE the bear market that emerged in January through March 2022. Individual stocks were not performing well even as the indexes acted very strong and made new highs. These signals were a great leading indicator of poor stock market results overall and enabled users to be out of the market in individual stocks before the selling commenced.

Here’s a screenshot of the Action Signals before the Nasdaq finally rolled over into a strong correction starting on February 17th. Our Action Signals showed little to no exposure to stocks going into that correction.

So, for investing in any individual stocks and non-index ETF, be sure to check out the signals before investing.

2) Invest During Uptrends

To buy stocks at the optimum time – when the market overall is most likely to head higher – the market trend must be in Market In Uptrend.

During a Market In Uptrend the market technicals and indicators are giving you the green light to buy.

It’s best not to buy when the trend is Uptrend Uncertain or Market in Downtrend. The odds of your stocks going up are greatly reduced.

Why?

Because over 75% of stocks follow the overall market trend!

If the trend is down, any stocks that you buy are more likely to go down than up. That’s why we wait until we have a Market in Uptrend status before buying.

The day the market trend changes from Market in Downtrend to Market In Uptrend – a follow-through day – is very important to watch out for.

Starting on that day, top growth stocks start racing out of the gate into new highs. More and more stocks will break out in the following days and weeks if the uptrend remains solid and continues to move higher.

The start of a new uptrend is the optimum time to be buying!

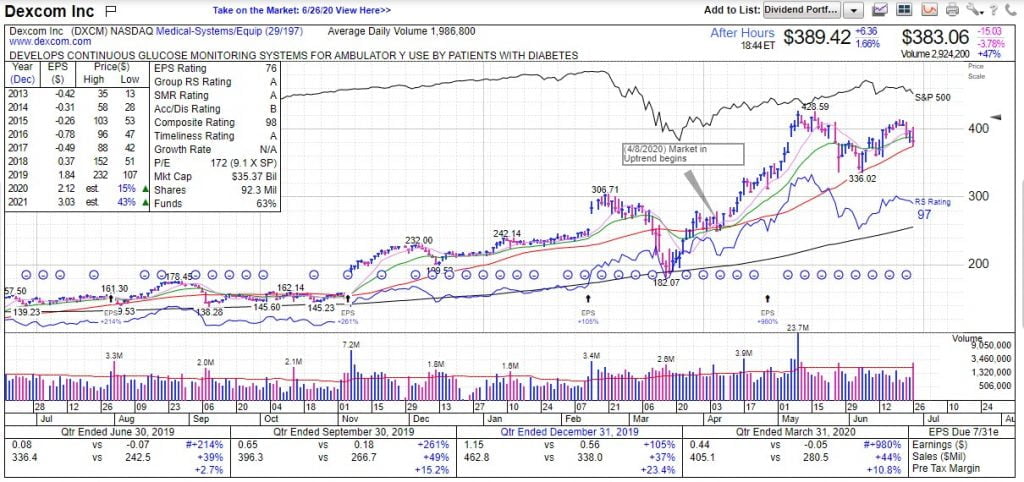

Here is a chart of Dexcom which took off right after a new uptrend started on April 8, 2020 (click to enlarge):

The first stocks making new highs after a correction are frequently the leaders of the new uptrend! So, make sure you watch out for them.

How to find the best stocks? Just use a screener.

If you are new to using screeners, please check out my How To Use A Stock Screener to Find Top Stocks article.

Which Index Should I Use To Track My Stocks?

The Market Trend Advisory tracks the Nasdaq and S&P 500 indexes separately. Most stocks are listed on the Nasdaq or the New York Stock Exchange (NYSE).

90% of the time, the indexes track each other pretty closely. But occasionally one index will outperform the others and become the leader. So, it’s important to use the signals for the more appropriate market index.

Technology stocks would be tracked by the Nasdaq. This would include software, hardware, cloud computing, payments, biotech, chips, Internet, and solar stocks.

The S&P has both stocks that are listed on the Nasdaq as well as the NYSE. It contains a wide range of sectors and many larger tech stocks like Microsoft, Intel, and Apple.

Follow the S&P index for non-tech stocks like those in consumer, cyclical, retail, banking, utilities, real estate, and homebuilding sectors.

But, newer fast-growing names, even in non-tech sectors, can be tracked under the Nasdaq.

For example, popular fast-growing restaurants like Wingstop or Chipotle that are listed on the NYSE often turn into high-growth names.

As a quick tip, the number of letters in a stock’s ticker symbol corresponds to the Index it is part of:

- Nasdaq listed stocks generally have 4 letters in their ticker symbols.

- NYSE listed stocks will have 1,2 or 3 letters. These generally will track better on the S&P 500.

If you’re unsure, learning which industry group or sector that your stock is in will help you determine which index to track.

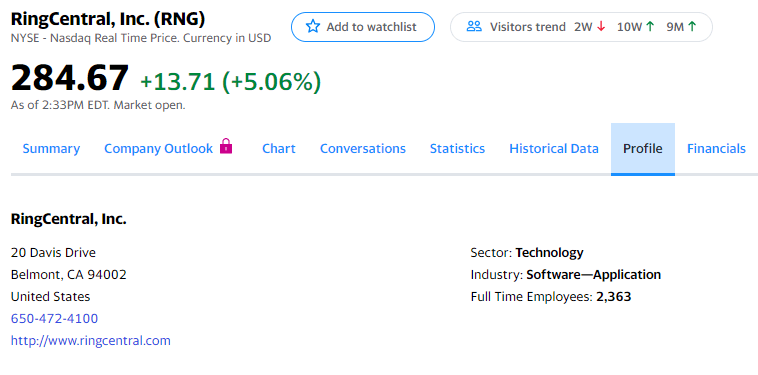

To find out the industry sector and industry, you can go to finance.yahoo.com and enter the stock’s ticker symbol. Click on the Profile tab and you’ll see the Sector and Industry.

The example below shows you that Ring Central is a tech stock in the Software-Application sector (click to enlarge):

Using The MTA With Different Investing Styles

Let’s go over some ways you can use the MTA with trading styles like swing trading, position trading, and long-term investing.

Swing Trading

Swing trading refers to holding a stock for a short period of time, usually from a couple of days to a couple of weeks. The object is to get a 5% to 10% gain and exit the trade.

Swing trading should be done only when we are in a Market In Uptrend.

However, the best time to swing trade is during a Power Trend. Power Trends are when the indexes are trending upward and they are above their major moving averages, all signs of a strong market.

It is during a Power Trend that stocks tend to make large moves quickly which is ideal for swing trading.

The Market Trend signals will help you to determine when the uptrend is at its most powerful, or when it is starting to wane as institutional selling days start to accumulate and the market count is starting to fall. Use these indicators to help you wade in and out of the market.

Always make sure the Individual Stock/ Non-Index ETFs Action Signals are in your favor, no matter the market trend!

Position Trading

Position trading refers to holding stocks anywhere from a few weeks to a few years. Position traders look to take both short-term profits and hold out for long-term gains.

Again, the most powerful indicator is the overall Market Trend for showing you when you should be buying, selling or holding.

The Market Trend signals and the Market Count (plus the Recommended Exposure % indicator) will help you trim positions when the trend is weakening, exit positions when we enter a market correction, or add to positions when the trend is strong.

Again, always make sure the Individual Stock/ Non-Index ETFs Action Signals are in your favor, no matter the market trend!

Long-Term Investing

Long-term investors are those who buy stocks and hope to never have to sell them.

In today’s volatile markets, it is sometimes difficult to hold big positions when 25% to 35% declines are frequent and common.

One solution to this problem is to trade around your position.

With this strategy, you always hold a core position that is your lowest cost basis stock, and use the buy and sell signals to trade around the rest of your position.

This will have you taking profits when the stock is at highs and adding back at key moving averages or when new bases form.

Long-term investing is best done in tax-deferred accounts where capital gains are not an issue.

Best Practices When Buying

In general, you should look to buy stocks listed on the strongest index, in the best performing industry groups.

Once a market uptrend begins, just gradually enter the market with a position or two.

Though it can be tempting, do not plunge in with lots of stocks right away and get 100% invested.

If your initial positions start to make money, continue to add. Let the market tell you that it’s conducive to making money, and let the market prove itself that it deserves you adding more hard-earned capital.

If the uptrend starts to falter or your particular stocks are not acting right, you should gradually pull back and exit or reallocate your capital to other stocks that are acting better or are more promising.

Selling

Knowing when to sell is the most difficult part of stock investing.

All investors have different criteria for selling; some are very short-term traders and others hope to hold their stocks virtually forever.

There is a saying that you should date stocks, not marry them.

No matter what company you invest in, 99% of them will eventually top and out and decline. For high-growth names, studies have shown that once a leader tops out, it can decline 80% from its peak.

Ultimately, all stocks need to be sold to lock in profits that have accumulated. So, you must have a plan for taking some profits at times, even for long-term investors.

Market Trend Advisory Sell Signals

The MTA provides sell signals when conditions warrant it. Sell signals are generated when the markets are coming under pressure, and frequently are early warning indicators of much more intense selling later.

There are also sell signals listed in the Individual Stock/ Non-Index ETFs Action Signals columns.

Again, most stocks will be falling or at best not making any progress once sell signals start to appear. It’s an opportune time to take some profits.

Use the Recommended Exposure % column to guide you as to how much you should sell.

This number shown is the recommended maximum invested amount you should have. Even though you may not have that amount invested in the market or in a stock, use the changes as a guide to lighten up and take profits. A sell signal may have you just trim your position which could be 5% to 10%.

However, if your stocks are not acting well or continually falling while the market is rising, you need to take whatever action is necessary. Sell signals in individual stocks override sell signals in the indexes!

Gradually In, Gradually Out

It’s almost never a good idea to sell 100% of your stocks at one time. Gradually sell a little and see what the market and your stocks do afterward.

Often there are sharp shakeouts that literally shake out weak holders and quickly head higher. Selling in parts will help you to keep at least part of your position if a shakeout occurs.

Plan First, Trade After

Studying top investors and their techniques, you’ll learn that all of them stress the importance of having a system for taking profits. For profits can disappear quickly when the market turns and goes into a correction.

And, when a stock trade isn’t profitable and falls below your purchase price, you must have a plan to sell out with a small loss to guard against losing large amounts of money if the stock continues to decline.

For a detailed look into selling strategies, please see my Stock Selling Rules & Strategies: Maximize Your Profits article.

Individual stocks generally move along with the overall market trend. But market leaders will vastly outperform the indexes and laggards will underperform.

So, look at what each of your stocks is doing relative to the indexes, your other stock holdings, and relative to the leaders.

Summary

Use the Market Trend indicators, along with specific selling strategies to take profits on your stocks.

Again, always make sure the Individual Stock/ Non-Index ETFs Action Signals are in your favor, no matter the market trend!

It’s important to have a selling plan or strategy in place before you place your trade. Then you just work your plan, which helps keep emotions out of your decisions which usually lead to mistakes.

———————————————————————————————

proptradefirm

I found a lot of useful information on your site. Thank you for the valuable information.