[printfriendly]September 10, 2013:

Municipal bond investing should be a part of every investor’s investing strategy. Municipal bonds, or munis, are one of the few investments that are tax-free at the federal level, and tax-free at the state level if the bond or bond fund invests in municipal bonds in the state you live.

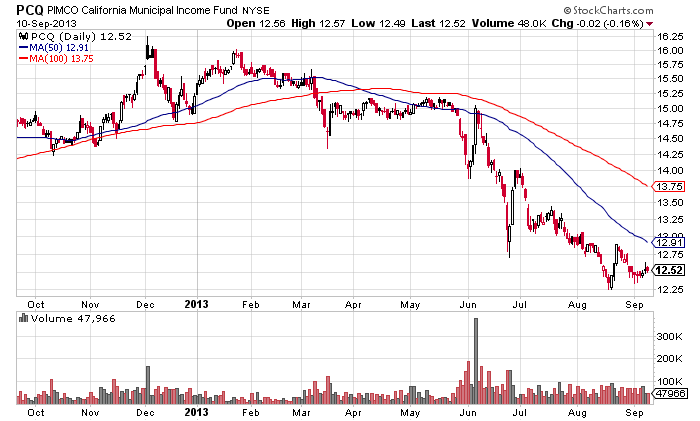

Today I added to one of my municipal bond closed-end funds, the Pimco California Municipal Income Fund (PCQ) with a purchase at 12.65.

I have been watching the muni bond market for awhile (see my August 1 Blog post), and I think we are just about at the end of the selloff that started back in May when interest rates started to rise. Most municipal bond funds are down 25-30%, and PCQ is no exception:

(Click to enlarge)

The chart shows what looks like a W bottom forming. A break above the 12.89 high formed on August 22nd will confirm the W bottom pattern.

Make sure you include municipal bond investing as part of your overall investment strategy. Not having to share your investment return with the government is a major plus!

Leave a Reply